09 | Investor relations

Share Information

| Exchange | Oslo Stock Exchange |

| ISIN | BMG4233B1090 |

| Ticker | HAFNI |

| Class of shares | 1 |

| Number of shares | 462,357,016 |

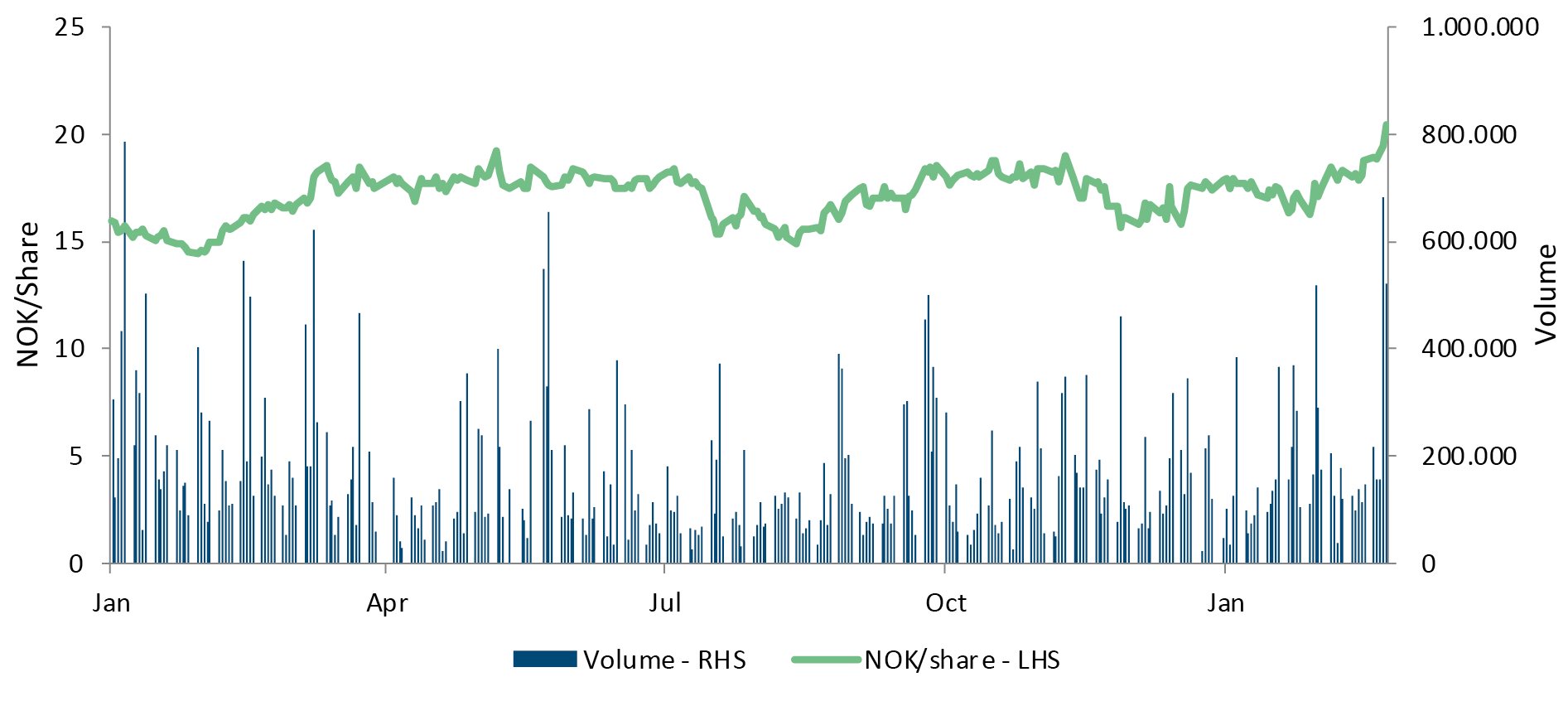

| Year high | 19.20 NOK (10 May) |

| Year low | 14.42 NOK (1 Feb) |

Communication

Hafnia is committed to building trust and confidence within the investor community, through the comprehensive and timely disclosure of information that is material or that may influence the price of Hafnia shares. To achieve this, Hafnia adopts the practice of regularly communicating major developments in its businesses and operations through the appropriate media channels such as news releases, stock exchange announcements, direct announcements, investor presentations and annual reports.

Hafnia also adopts transparent and effective communication practices to enhance standards for the investor community through efficient use of technology. Hafnia’s corporate website has a dedicated ‘Investor Relations’ segment, which features the latest and historical financial results, investor presentations, investor tools, financial calendar and analyst coverage of Hafnia. These features aim to provide both new and existing shareholders comprehensive information about Hafnia so shareholders can make informed decisions regarding Hafnia shares.

Hafnia understands the importance of maintaining good stakeholder relationships and employs an inclusive active approach to engaging with the investor community. The contact details of the Investor Relations team are available on the corporate website, allowing shareholders to reach out to Hafnia easily. The Investor Relations team strives to address any shareholder’s query as soon as possible. Hafnia hopes this helps to foster better communication with the investor community to convey their investment proposition, as well as obtaining feedback on its expectations.

Dividend policy

The Company targets a quarterly dividend based on a pay-out ratio of 50% of annual net profit, adjusted for extraordinary items. The final amount of dividend is to be decided by the Board of Directors. In addition to cash dividends, the Company may buy back shares as part of its total distribution to shareholders.

In deciding whether to declare a dividend and determining the dividend amount, the Board of Directors will take into account the Group’s capital requirements, including capital expenditure commitments, financial condition, general business conditions, legal restrictions, and any restrictions under borrowing arrangements or other contractual arrangements in place at the time.

There can be no assurance that a dividend will be declared in any given year. If a dividend is declared, there can be no assurance that the dividend amount or yield will be as contemplated above.

Dividends distributed to shareholders of the Company for the fiscal year 2018 was USD nil. The Company declared a dividend of USD 21.2 million for the fiscal year 2019. Together with the interim dividends paid for Q1 2020 and Q2 2020 of USD 0.1062 per share in both quarters, the total dividend paid in fiscal year 2020 amounted to USD 0.2708 per share or USD 98.3 million. The Company did not pay a dividend for the fiscal year 2021.

Composition of shareholders

As of 28 February 2022, Hafnia has 1,115 registered shareholders. Below is a list of the 20 largest shareholders as per 28 February 2022:

| # Shareholder Name | No. of Shares | Percentage (%) |

| 1 BW GROUP LIMITED | 246,106,112 | 53.23% |

| 2 OCM (Gibraltar) Chemical Tankers | 94,338,624 | 20.40% |

| 3 PAG Tankers Limited | 20,411,403 | 4.41% |

| 4 J.P. Morgan Securities LLC | 9,504,987 | 2.06% |

| 5 Danske Bank A/S | 8,170,963 | 1.77% |

| 6 The Bank of New York Mellon | 7,176,038 | 1.55% |

| 7 Northwharf Nominees Limited | 6,973,800 | 1.51% |

| 8 DBSI CE HSE CLR | 4,860,770 | 1.05% |

| 9 Interactive Brokers LLC | 3,829,264 | 0.83% |

| 10 Pershing LLC | 3,474,718 | 0.75% |

| 11 SKANDINAVISKA ENSKILDA BANKEN AB | 3,336,115 | 0.72% |

| 12 State Street Bank and Trust Comp | 3,251,665 | 0.70% |

| 13 PERESTROIKA AS | 3,000,000 | 0.65% |

| 14 Skandinaviska Enskilda Banken AB | 2,828,747 | 0.61% |

| 15 CASTEL AS | 2,371,258 | 0.51% |

| 16 VERDIPAPIRFONDET STOREBRAND NORGE | 1,694,132 | 0.37% |

| 17 Viking Investments (Cayman) Ltd | 1,658,605 | 0.36% |

| 18 AGAT AS | 1,346,498 | 0.29% |

| 19 SPESIALFONDET KLP ALFA GLOBAL ENER | 1,301,898 | 0.28% |

| 20 BNP Paribas Securities Services | 1,292,150 | 0.28% |

| Other shareholders | 35,429,269 | 7.66% |

| Total | 462,357,016 | 100% |

Stock data, ticker code

Financial calendar

| Financial Year 2022 | |

| 15 March 2022 | Quarterly report – Q4 |

| 30 March 2022 | Annual report 2021 |

| 20 May 2022 | Annual general meeting |

| 23 May 2022 | Quarterly report – Q1 |

| 26 August 2022 | Half-yearly report |

| 21 November 2022 | Quarterly report – Q3 |

Investor relations contacts

- Mikael Skov, CEO, ms@hafniabw.com

- Perry Van Echtelt, CFO, pve@hafniabw.com

- Thomas Andersen, EVP, IR, Research and

Performance Management, tha@hafniabw.com

Analyst coverage

- Arctic, Lars Bastian Østereng, lars.ostereng@arctic.com

- Clarksons, Frode Mørkedal, Frode.Morkedal@clarksons.com

- Danske Bank, Håvard Sjursen Lie, hvli@danskebank.com

- Fearnley, Peder Jarlsby, pnj@fearnleys.no

- H.C. Wainwright & Co., Magnus Fyhr, mfyhr@hcwco.com

- Pareto Securities AS, Eirik Haavaldsen, eha@paretosec.com

- Pareto Securities AS, Wilhelm Flinder, willhelm.flinder@paretosec.com

- Skandinaviska Enskilda Banken, David Bhatti, david.bhatti@seb.no